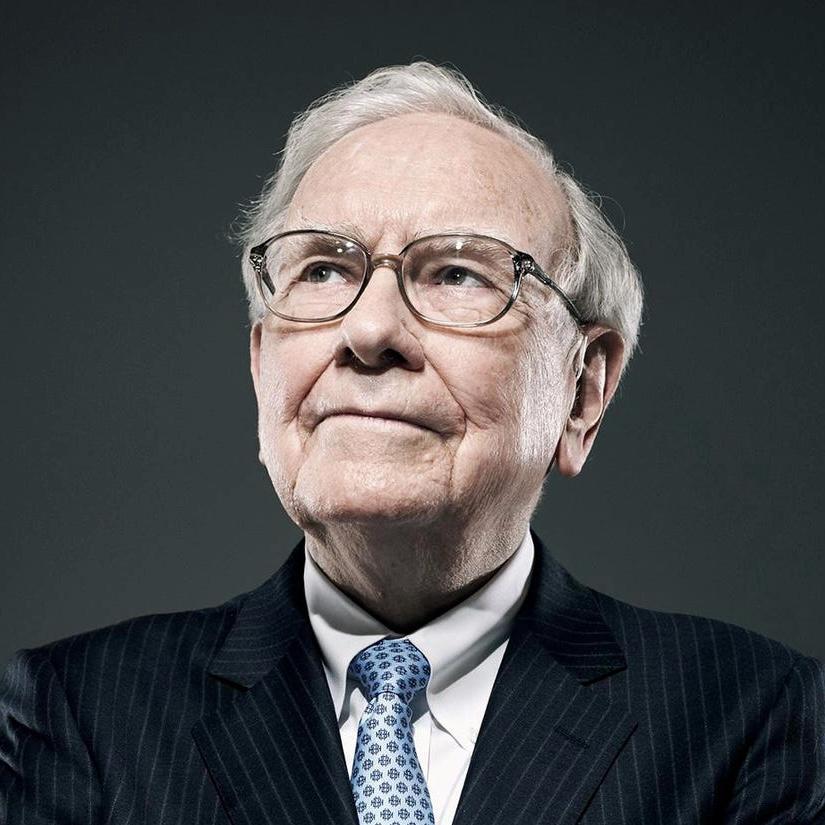

According to Bloomberg, Warren Buffett, the chairman of Berkshire Hathaway and a billionaire investor, held multiple conversations with members of President Biden’s team over the past week, discussing the possibility of him potentially investing in the regional US banking system to stabilize it. During the calls, Buffett also provided “advice and guidance” to the White House officials on how to respond to the US banking crisis. Buffett has a history of helping to bolster US banks during periods of economic stress, particularly during the 2008 financial crisis when he invested $5 billion in Goldman Sachs.

Currently, regional banks are facing a run from concerned depositors after the collapse of Silicon Valley Bank and Signature Bank of New York. This has fueled worries about global economic contagion, particularly after trouble at First Republic and Credit Suisse. Despite the largest US banks’ efforts to rescue First Republic with a $30 billion bailout, its stock has remained under intense pressure, and shares were down as much as 37% in premarket trading on Monday.

Meanwhile, S&P slashed First Republic’s credit rating to B+ from BB+ on Sunday, and investors have expressed skepticism about UBS’s $3.2 billion deal to take over Credit Suisse. The latter has been in danger of collapse for days after disclosing “material weaknesses” in its financial reporting, leading to a crisis of confidence. The bank’s shares, along with UBS’s, were down in Monday trading.

Despite a move by federal regulators, backed by President Biden, to guarantee all deposits at Silicon Valley Bank and Signature Bank following their collapse, bank stocks have struggled, and critics argue that this move was a bailout that will eventually lead to higher costs for bank customers. Biden and other administration officials have repeatedly stated that US taxpayers won’t be on the hook for the federal intervention.